How to Apostille IRS Form 6166 for the Philippines

How to Apostille IRS Form 6166 for the Philippines

The Philippines and the United States have a tax treaty in place. The purpose of this tax treaty is to prevent double taxation of income that is earned by residents of one country in the other country. The treaty provides guidelines for the allocation of taxing rights between the two countries, and specifies the methods for determining taxable income and deductions.

Under this tax treaty, residents of one country who earn income in the other country are generally entitled to certain tax benefits, including reduced tax rates and exemption from certain types of taxes. For example, the tax treaty provides for a reduced withholding tax rate of 15% on dividends paid to residents of the other country, as compared to the standard rate of 30%.

The tax treaty also includes provisions for the exchange of information between the two countries, in order to prevent tax evasion and ensure compliance with the tax laws of each country.

Overall, the tax treaty between the Philippines and the United States provides a framework for the taxation of cross-border income and helps to promote trade and investment between the two countries.

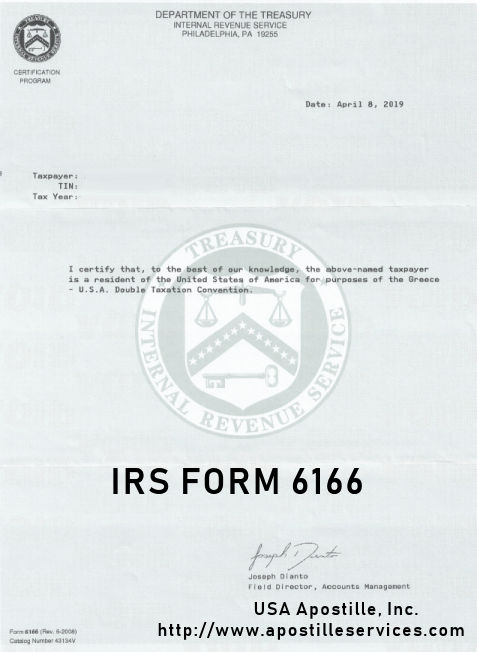

IRS Form 6166 is a document issued by the Internal Revenue Service (IRS) of the United States that certifies an individual’s or entity’s status as a resident of the United States for tax purposes. This form is commonly used to claim tax treaty benefits in foreign countries.

Foreign tax authorities may require Form 6166 as proof of residency in order to claim a reduced rate of tax withholding on income that is sourced in the United States. This can include income from sources such as dividends, interest, and royalties.

To obtain Form 6166, an individual or entity must submit a completed Form 8802, Application for United States Residency Certification, to the IRS. The Form 8802 requests information about the applicant’s tax status and the specific tax treaty benefits that are being sought.

Once the Form 8802 is processed and approved by the IRS, the applicant will receive Form 6166, which certifies that they are a resident of the United States for tax purposes and are entitled to the specific tax treaty benefits requested. The form is valid for a period of three years from the date of issuance.

To apostille IRS Form 6166, you will need to follow these steps:

- Obtain the original IRS Form 6166 from the Internal Revenue Service (IRS). You can request this form by submitting a completed Form 8802 to the IRS.

- Mail in the original IRS Form 6166 with our Washington DC Apostille order forms to our Washington, D.C. office. IRS 6166 is not notarized.

You will typically need to provide the following information and documents when requesting an apostille:

- The original IRS Form 6166 that has been notarized.

- A completed application for an apostille, which is typically available from the state authority’s website.

- The required fee for the apostille.

Once you have obtained the apostille, the IRS Form 6166 will be recognized as a valid document in foreign countries that are party to the Hague Apostille Convention. The apostille verifies the authenticity of the document and allows it to be used for legal purposes in the foreign country.

Obtaining an apostille on IRS Form 6166 for the Philippines can be complicated. Don’t leave this process to untrained employees or non-professionals who do not fully understand the Apostille process and the unique requirements of certain countries. Your paperwork could be rejected costing you time and money. Don’t let this happen to you!

Do you need to apostille your IRS tax documents?

Do you need to apostille your IRS tax documents? Do you need an apostille on your U.S. Residency Certificate IRS Form 6166?

Do you need an apostille on your U.S. Residency Certificate IRS Form 6166?